Goalvest 2026 Market Outlook (AI Investment)

12/16/2025

Our view on the AI investment cycle is that careful selection is increasingly important. The cycle is long, and today’s leaders may not be tomorrow’s winners. History shows us that choosing Cisco or EBay in 2000 led to very different outcomes than choosing early YouTube. The same dynamic applies today. Not every segment of the AI value chain will benefit equally, and this divergence is often how bubbles form. Zoom is a useful recent example. Revenue rose from $2.6b in 2020 to $4.1b in 2021, pushing its valuation above $100b. Today, it is valued near $26b on $4.8b of revenue, illustrating how quickly valuations can reset as growth normalizes.

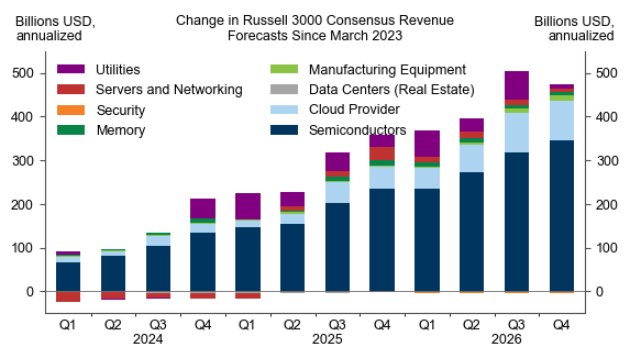

At the first phase of AI, the hardware side, the data center buildout cycle has primarily benefited component suppliers. Connectivity, memory and computing chips, foundry capacity, and electricity have seen strong demand against constrained supply. As shown in the chart, equity analysts expect data center–related revenues to grow 47% from current levels by the end of 2026. However, neo cloud providers such as Oracle, which borrowed heavily to fund data center construction, face pressure as high buildout costs and leverage outpace revenue growth and free cash flow generation. Hyperscalers are better positioned, as they mitigate these costs through long term contracts with neo cloud providers to host servers and workloads.

At the second phase, software and AI applications, the key questions are monetization and enterprise adoption. The market is effectively split between an OpenAI ecosystem and a Google ecosystem, each with distinct economics. Google currently has an advantage, as AI enhances existing products such as Search and Chrome while directly supporting advertising revenue. Some high valuation companies, including Palantir and Tesla, show meaningful potential in enterprise AI and robotics. However, these innovations have not yet changed everyday behavior in the way social media or smartphones once did, leaving room for valuation uncertainty.

Finally, the last phase of AI is broad diffusion, where productivity gains or cost savings spill across all sectors. In this context, investing in the S&P 500 results in over 40% exposure to Information Technology and Communication Services combined, with the remaining 60% allocated across other sectors. While improved access to data and predictive tools may help reduce the risk of a single large bubble, high concentration and elevated valuations typically point to lower average forward returns compared with the 13% average annual return over the past 15 years and 19% over the past 3 years.

In this environment, we are emphasizing diversification within multi asset portfolios, participating in market upside while positioning to take advantage of dislocations during periods of volatility.

Sources: Factset, Goldman Sachs

Disclaimer

GoalVest Advisory is a SEC registered investment adviser. Information presented is for educational purposes only intended for a broad audience. The information does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. GoalVest Advisory has reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investment, or client experience. GoalVest Advisory has reasonable belief that the content as a whole will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Please refer to Form ADV Part 2A the adviser’s ADV Part 2A for material risks disclosures. Past performance of specific investment advice should not be relied upon without knowledge of certain circumstances of market events, nature and timing of the investments and relevant constraints of the investment. GoalVest Advisory has presented information in a fair and balanced manner. GoalVest Advisory is not giving tax, legal or accounting advice, consult a professional tax or legal representative if needed.