Goalvest 2026 Market Outlook (Macro Economy)

12/10/2025

Today’s FOMC meeting set the tone for 2026. The Fed delivered a 25 bps cut, with three officials dissenting — two preferring to hold rates unchanged and one favoring a larger 50 bps cut — bringing the Fed Funds range to 3.50%–3.75%. The committee projects end‑2026 median real GDP at 2.3%, the unemployment rate at 4.4%, PCE inflation at 2.4%, and the policy rate at 3.4%, implying 1 to 2 cuts next year. Globally, monetary policy remains largely in an easing phase, with the Bank of Japan as the outlier expected to raise rates in its meeting next week.

US growth expectations remain resilient. JP Morgan and Goldman Sachs see real GDP near 3% in 1H 2026 on easier policy and ongoing fiscal support, then moderating toward 1% in 2H as stimulus fades, ending the year near 2%. AI investment and adoption continue to provide a structural boost to productivity. Outside the US, consensus growth aligns with long term trends, with developed markets near 1.5% and emerging markets near 3.7%.

Inflation indicators have been moving sideways, with core PCE at 2.8%. As tariff effects fade in the coming quarters, the underlying secular trend of lower inflation may become more apparent. Gasoline prices have eased, while shelter inflation remains sticky due to supply constraints. This provides the Fed with room to shift its guidance toward labor conditions, rather than focusing solely on inflation restraint.

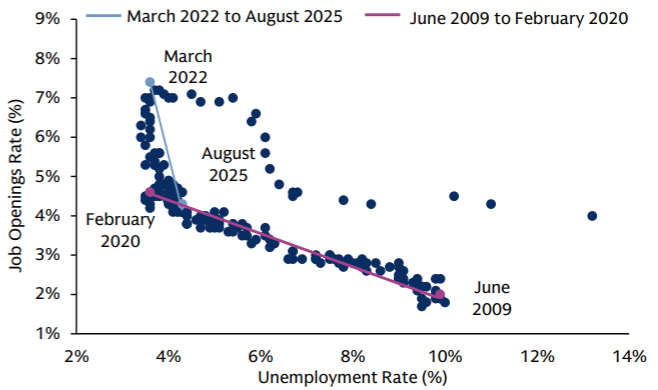

Labor conditions are now the central variable. Job openings have been declining since March 2022 and unemployment has reached 4.4%. As the above chart shows, the economy may be close to a point where cooling shows more through layoffs rather than slower hiring. This labor inflection is expected to have a greater influence on the Fed’s stance than inflation, particularly heading into a midterm election year and with a new Fed chair anticipated to balance administration priorities with policy credibility.

Short-term yields are closely tied to the Fed policy rate, and yields on savings accounts, money market funds, and Treasury bills will decline as the Fed eases. Long-term yields may remain elevated due to growing fiscal deficits and policy uncertainty, unless economic growth slows more noticeably or inflation falls further. The Fed’s neutral rate is expected to be near 3%, higher than the average of the past decade. The US dollar could weaken modestly as monetary easing continues.

Overall, we are entering 2026 with more supportive monetary policy than in 2025. The Fed has concluded quantitative tightening, delivered three rate cuts this year, and signaled its readiness to stabilize liquidity in the banking system through targeted short-term Treasury purchases. Goldilocks conditions in the economy are expected to persist, with above-trend growth next year, inflation having improved and projected to ease further in 2026, while labor conditions continue to soften. We anticipate that macroeconomic developments and Fed policy will continue to provide a tailwind for the stock market, though expectations should remain measured, as equity markets typically price in conditions several quarters ahead.

Sources: JP Morgan, Goldman Sachs, Ned Davis Research

Disclaimer

GoalVest Advisory is a SEC registered investment adviser. Information presented is for educational purposes only intended for a broad audience. The information does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. GoalVest Advisory has reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investment, or client experience. GoalVest Advisory has reasonable belief that the content as a whole will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Please refer to Form ADV Part 2A the adviser’s ADV Part 2A for material risks disclosures. Past performance of specific investment advice should not be relied upon without knowledge of certain circumstances of market events, nature and timing of the investments and relevant constraints of the investment. GoalVest Advisory has presented information in a fair and balanced manner. GoalVest Advisory is not giving tax, legal or accounting advice, consult a professional tax or legal representative if needed.