Private sector drives silver rally

1/13/2025

Silver has rallied sharply in recent quarters, lifting its market value to about $4.9T, second only to gold at roughly $32T and now larger than Nvidia at around $4.4T. The move has drawn increased investor attention alongside gold. To understand the rally, it is helpful to break it down across supply and demand dynamics, inventory conditions, and investor behavior.

On the supply side, roughly 70% of silver global production comes as a byproduct of copper, lead, and zinc mining, which limits how quickly supply can respond to higher silver prices. Production decisions are tied to base metal economics, not silver itself. Demand has been supported by industrial uses, which account for more than half of total consumption. Solar, electrification, semiconductors, and data infrastructure continue to drive steady, long-term demand, and much of the silver used in these applications is not economically recycled. Since we’re currently in a data center buildout cycle, the increasing demand has somewhat driven up the silver price.

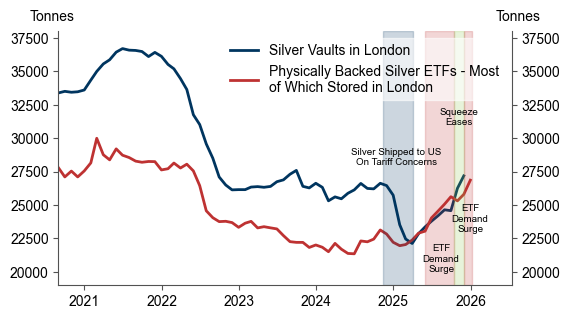

Market mechanics and relative valuation have acted as the key accelerants as shown in the above chart. ETF inflows have increased as investors seek a higher beta version of gold amid a broader theme of dollar diversification. At the same time, inventories in London — the primary hub for physical silver delivery and prices are determined — have tightened as concerns around potential US tariffs prompted a transfer of metal into US vaults. This inventory relocation reduced available supply in the benchmark market and encouraged precautionary buying and inventory hoarding. Against this backdrop, the gold/silver price ratio began this cycle at historically high levels, signaling that silver was lagging gold in price movement. As gold moved higher on central bank demand, silver followed through a catch-up trade, with inventory tightness and speculative positioning amplifying the move.

So, in our view, silver is currently being treated as a higher volatility version of gold, with speculative elements factoring in: expectations of a 50% tariff on silver, low inventories in London, and strong ETF inflows playing an outsized role. The gold/silver price ratio has moved back toward the lower end of its historical range, suggesting more limited upside for silver relative to gold from here. While gold demand is primarily driven by central banks, the recent move in silver has been led by private sector flows. As a result, we continue to prefer gold as the straightforward safe haven and dollar debasement trade.

Sources: companiesmarketcap.com, Goldman Sachs

Disclaimer

GoalVest Advisory is a SEC registered investment adviser. Information presented is for educational purposes only intended for a broad audience. The information does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. GoalVest Advisory has reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investment, or client experience. GoalVest Advisory has reasonable belief that the content as a whole will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Please refer to Form ADV Part 2A the adviser’s ADV Part 2A for material risks disclosures. Past performance of specific investment advice should not be relied upon without knowledge of certain circumstances of market events, nature and timing of the investments and relevant constraints of the investment. GoalVest Advisory has presented information in a fair and balanced manner. GoalVest Advisory is not giving tax, legal or accounting advice, consult a professional tax or legal representative if needed.