Can gold be the missing piece in today’s portfolio?

6/5/2025

Portfolio diversification is based on the idea that different asset classes react differently to economic conditions. A classic example is the mix of stocks and bonds—stocks typically fall during slow growth, while bonds often rise during the same time because interest rates tend to drop.

But this relationship broke down in 2022, when both stocks and bonds declined sharply. The reason? Inflation and aggressive rate hikes. Higher rates hurt stocks through rising costs and hit bonds through falling prices, while inflation eroded fixed income returns.

In 2023 and 2024, markets rebounded. A strong U.S. dollar and resilient large-cap tech stocks led the rally. The final stage of Fed tightening and high U.S. rates attracted global capital, temporarily restoring the balance across equities, bonds, and the dollar.

Now in 2025, the picture has shifted again. We're facing a rare and troubling combination:

The U.S. dollar is weakening, weighed down by tariffs and fiscal concerns despite still-high rates.

Equities are flat—earnings remain solid, but forward guidance is under pressure from rising costs and trade tensions.

Bonds are failing to hedge downside risks.

This reflects a new, U.S.-centric risk environment: slowing earnings growth, tariff-driven inflation uncertainty, and a widening fiscal deficit. When stocks, bonds, and the dollar are all vulnerable to the same risks, traditional diversification breaks down.

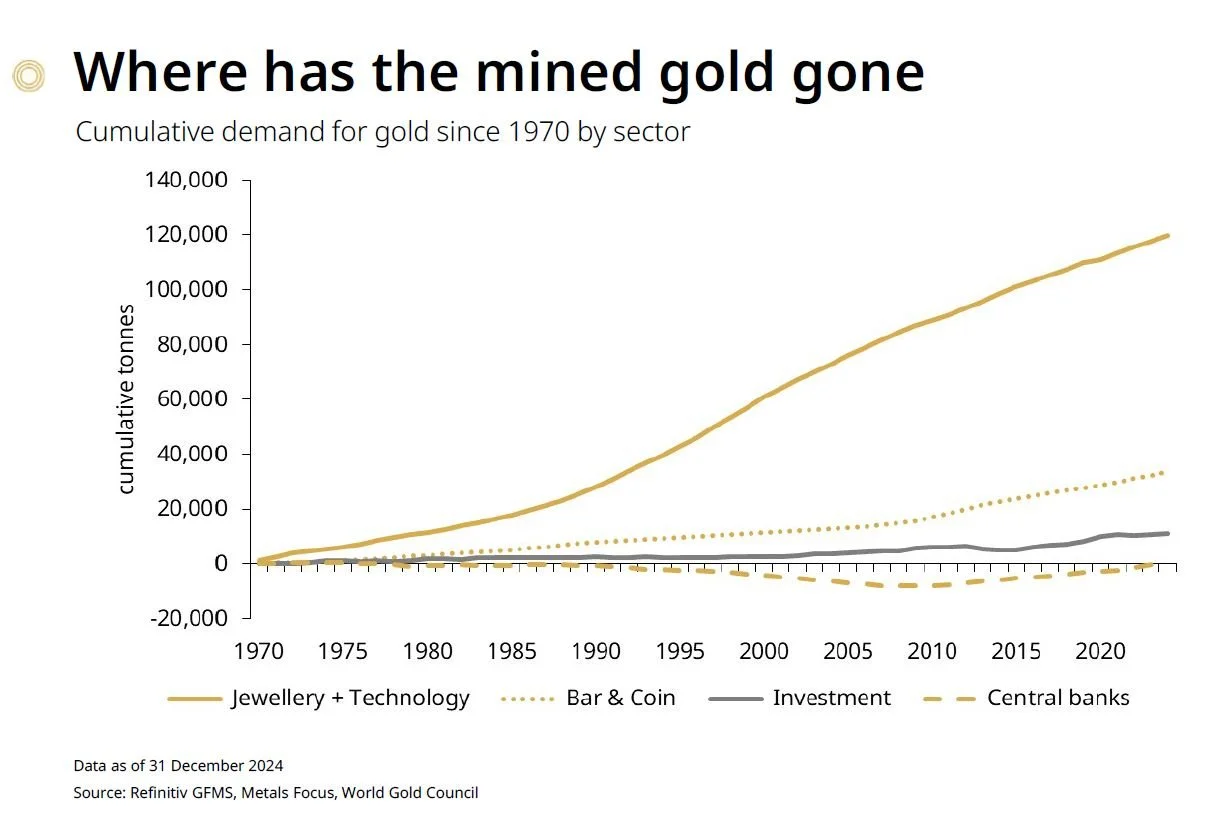

Given this backdrop, we believe adding gold to the portfolio is prudent. Gold brings exposure to a different set of macro sensitivities and has historically performed well during periods of dollar weakness, inflation, and sovereign credit concerns. Unlike financial assets, gold is largely held in the form of jewelry and technology component, meaning a significant portion is taken out of circulation. And its supply does not grow like money does. With U.S. assets under pressure, gold offers a valuable hedge and a complement to our international equity exposure which still faces geopolitical risks.

Disclaimer

GoalVest Advisory is a SEC registered investment adviser. Information presented is for educational purposes only intended for a broad audience. The information does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. GoalVest Advisory has reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investment, or client experience. GoalVest Advisory has reasonable belief that the content as a whole will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Please refer to Form ADV Part 2A the adviser’s ADV Part 2A for material risks disclosures. Past performance of specific investment advice should not be relied upon without knowledge of certain circumstances of market events, nature and timing of the investments and relevant constraints of the investment. GoalVest Advisory has presented information in a fair and balanced manner. GoalVest Advisory is not giving tax, legal or accounting advice, consult a professional tax or legal representative if needed.